After the storm comes a rainbow…

Today, mood is very low among a large number of real estate players: investors, developers, lenders, brokers… but real estate is cyclical, let’s not forget that!

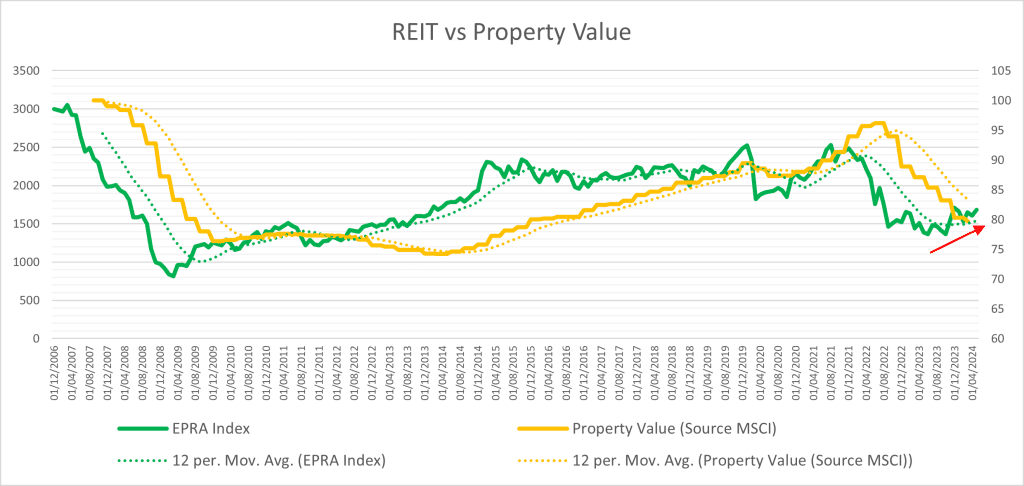

In recent weeks, some indicators have shown us that a recovery is underway for specific asset classes of real estate and in only few locations in Europe.

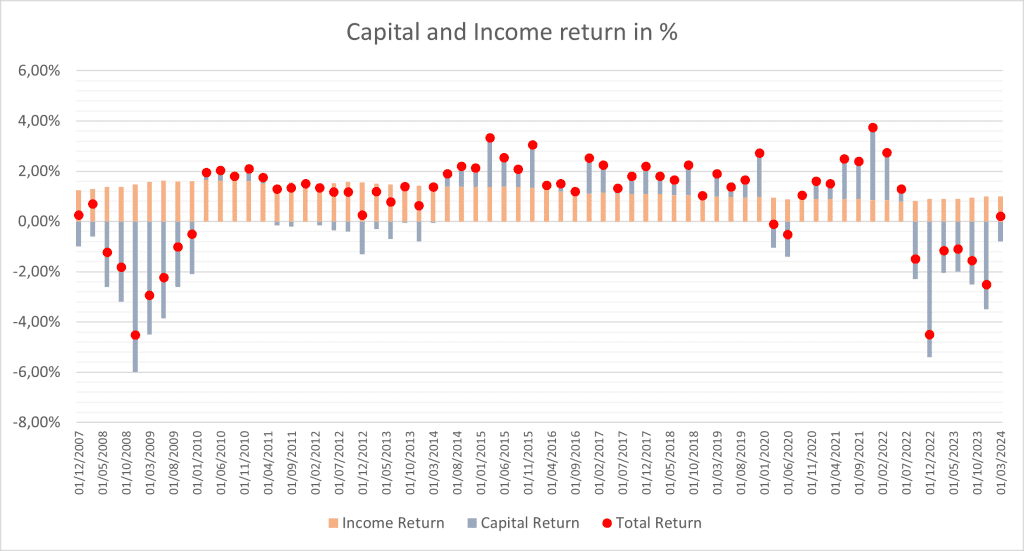

Despite the results of the European elections which have an upward impact on long-term interest rates in some European countries, we believe that a historic investment window is opening: this period should make it possible to seize very good opportunities due to the significant price drops observed since mid-2022 and the low number of active investors in the current real estate market.